Empowering Leadership with Strategic Asset Intelligence

In today’s dynamic business environment, C-suite executives need more than just data; they need actionable insights and strategic intelligence to drive their organizations forward. Tragging LLC’s asset tracking solution equips leaders with the tools and information necessary to make informed decisions about asset management, financial planning, and operational efficiency.

- Drive Business Growth

- Enhance Corporate Governance

- Optimize Resource Allocation

- Streamline Corporate Strategy

features

Empowering C-Suite Decision-Making with Asset Insights

Gain a complete view of your asset landscape for informed decision-making at all levels.

Tragging LLC offers a holistic view of the organization’s assets, enabling C-suite executives to understand asset performance, utilization, and their impact on strategic goals. This visibility extends across all levels, from granular asset tracking to high-level overviews, ensuring that decision-makers have the necessary information to assess asset efficiency and business value.

Analyze asset performance data to optimize costs, utilization, and financial strategies.

The solution provides in-depth financial analytics and operational data, crucial for strategic planning and investment decisions. It helps in identifying cost-saving opportunities, optimizing asset usage, and aligning asset management with financial objectives, enabling C-suite leaders to drive profitability and ensure fiscal responsibility.

Proactively manage risks and ensure regulatory compliance with automated tracking and reporting tools.

Mitigating risks and ensuring compliance with relevant regulations is a top priority for the C-suite. Tragging LLC’s system automates compliance tracking and risk assessment processes, offering detailed reporting for audit trails and regulatory reviews. This aids in proactive risk management and ensures that the organization adheres to legal and industry standards.

Access personalized key metrics for quick, data-driven decision-making.

Tailored dashboards provide C-suite executives with immediate access to key metrics and performance indicators that are crucial for strategic decision-making. These dashboards can be customized to reflect the priorities and preferences of individual executives, offering a personalized view of the organization’s asset landscape and performance.

Leverage predictive insights to anticipate future needs and drive forward-thinking asset strategies.

With advanced analytics and predictive modeling, Tragging LLC’s solution empowers C-suite executives to forecast trends, anticipate market changes, and prepare for future asset needs. This predictive intelligence supports strategic planning, helping to shape informed decisions that will drive the organization’s growth and success.

Benefits

Optimize Your Assets. Drive Your Strategy.

Comprehensive Asset Visibility

Gain a 360-degree view of your organization's assets, understanding their utilization, performance, and contribution to business objectives.

Risk Management and Compliance

Maintain full control over compliance and risk management processes, with detailed tracking and reporting capabilities that meet regulatory standards and reduce business risks.

Risk Reduction

Navigating the tightrope of asset management comes with its risks, but our EAM system acts as your safety net. From ensuring compliance with the latest regulations to maintaining assets in peak condition, we minimize the potential pitfalls that can derail your operations, helping you operate with confidence and security.

Customized Executive Dashboards

Get real-time, tailored insights through dashboards designed for C-suite executives, showcasing key performance indicators (KPIs) and metrics that matter most to your strategic goals.

Frequently Asked Questions

FAQs for C-suite and Tragging Asset Tracking Solution

- Q: How can Tragging LLC’s asset tracking solution drive strategic business decisions for the C-suite?

A: Tragging LLC’s solution provides executives with comprehensive data and analytics on asset performance and utilization, enabling strategic decisions on capital investments, operational improvements, and resource allocation. The insights derived from our system support long-term planning, market positioning, and financial optimization.

- Q: What kind of financial and operational insights can C-suite expect from the system?

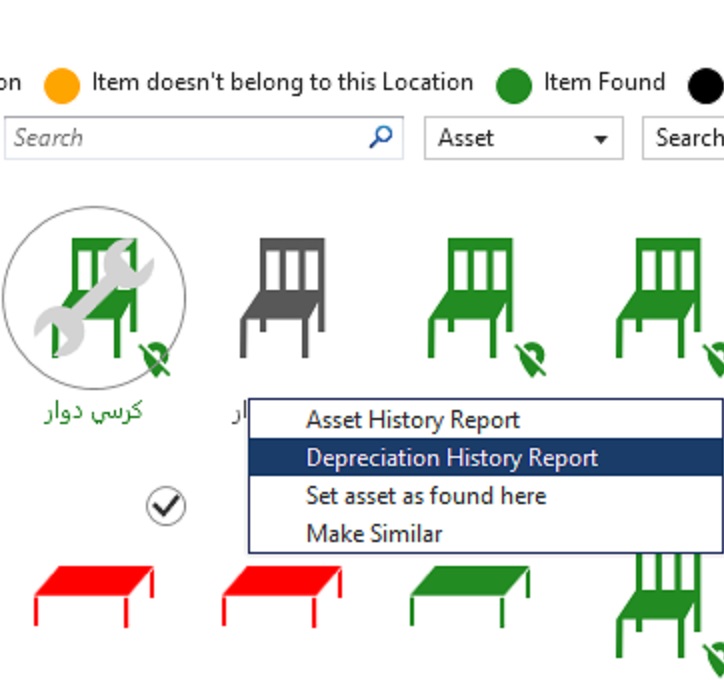

A: The system offers detailed financial analyses, such as ROI on assets, depreciation tracking, and cost-saving opportunities. Operationally, it provides insights into asset utilization rates, maintenance schedules, and lifecycle management, helping executives to optimize operations and enhance financial performance.

- Q: How does Tragging LLC ensure compliance and risk management for businesses?

A: Our asset tracking solution includes features for compliance tracking and risk management, automating the collection and reporting of necessary data to meet regulatory standards. This proactive approach helps in identifying and mitigating risks, ensuring that the business remains compliant with industry regulations and standards.

- Q: Can the Tragging LLC system be customized to meet specific C-suite needs and preferences?

A: Yes, our system is highly customizable, offering tailored dashboards, reports, and analytics to meet the specific needs and strategic focus of C-suite executives. This personalization ensures that leaders receive relevant, actionable insights to inform their decisions.

- Q: How does the asset tracking solution contribute to corporate governance and ethical management?

A: Tragging LLC’s solution promotes transparency and accountability in asset management, aligning with corporate governance principles. By providing a clear view of asset utilization and management practices, the system supports ethical management and helps in building trust among shareholders, regulators, and the public.

- Q: What long-term strategic benefits can the C-suite gain from implementing Tragging LLC’s asset tracking system?

A: By implementing our system, C-suite executives can achieve sustainable asset optimization, risk reduction, and financial savings. Long-term benefits include enhanced strategic planning, improved market responsiveness, and a strong foundation for driving business growth and innovation.